JillianCain

Lowe’s (NYSE:LOW) operates in the home improvement industry, a sector that will experience several long-term tailwinds. Its economies of scale help the business offer the greatest value proposition among competitors. With great management aligned with shareholders and a fair valuation, I think Lowe’s is a great business to include in many portfolios.

Business Model

Lowe’s is the world’s second-largest home improvement retailer. Founded in 1921, it is a Dividend King that has been raising the dividend for 57 years. It serves two types of customers, do-it-yourself (DIY) and PRO. It offers all kinds of products and services for home maintenance, repair, and improvement. Management is obsessed with customer satisfaction and return to shareholders. Moreover, the home improvement market has several tailwinds that will ensure its profitability in the coming years.

Secular Trends In Its Market

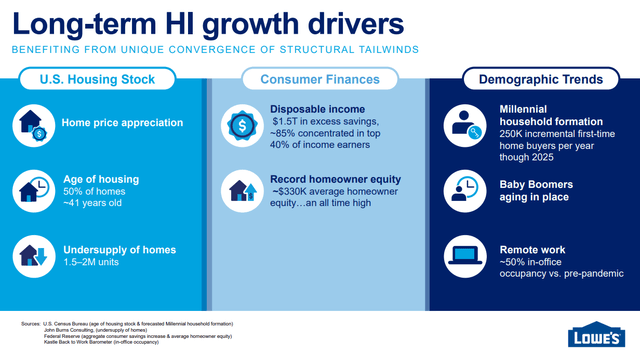

The company emphasizes 8 growth drivers, but some of them are structural problems in the US (Lowe’s only operates in the US, so it is highly dependent on its economy, although they avoid currency risk on their results), such as the age of housing and the undersupply of homes. Some others are macrotrends, such as baby boomers aging and remote work. (Slide 11)

Source: 2022 Analyst & Investor Conference

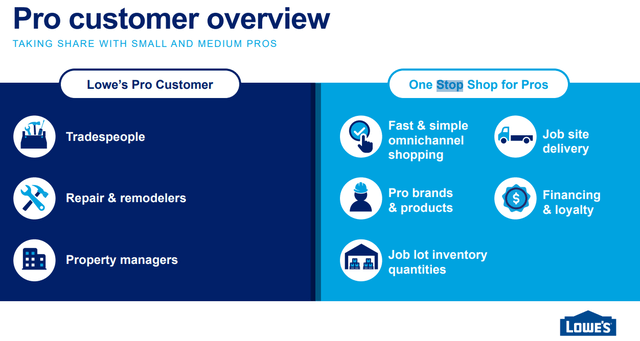

But not only the market prospects look attractive for Lowe’s, but also the market structure compared to its revenue mix. The home improvement market is a highly fragmented market with an estimated TAM of $1 trillion. (Home Depot has 15% of the market share and Lowe’s has 10%), so the options for consolidation are huge, but I will talk about this later. Moreover, the market is fragmented into two types of customers: DIY (50%) and PRO (50%), while Lowe’s revenues are formed by 25% of PRO customers (19% in 2019) and 75% of DIY. PRO customers are the profitable ones, since their purchases are not discretionary, they are more recurring, the tickets are larger, and the inventories rotate more, since they can charge extra prices for parts or labor. They intend to penetrate this market through partnerships and rewards, as well as relationships with new brands. Margins and resiliency of the product portfolio should be positively impacted. (Slide 10)

Source: 2022 Analyst & Investor Conference

One-stop Shopping Is The Biggest Competitive Advantage

What Lowe’s does, which is a great advantage compared to other smaller players, is become a one-stop shop for all of its customers. The company has not only the best and broader catalog of products, but also the best customer relationship, long-term relations with its suppliers for obtaining the best deals, a great transport fleet, and a huge shop footprint: about 1,700 shops (89% owned by the company) after closing operations in Canada (6% of sales) with a wide range of products offered (40,000 in store) and 2 million on the internet with 24-hour deliveries from central warehouses (15 regional centers and 15 surface flats).

They have been investing in omnichannel since 2018, giving them a greater degree of flexibility and convenience for the client. Customers can search on their website (10% online sales in 2022, compared to 5% in 2018) before going to the store, or they can pick it up at the store with a prior reservation. Products can be delivered to their home or workplace if they are very large (so they do not occupy or bother the store). These are all facilities to improve customer satisfaction and experience, which is key in retail businesses. (Slide 15)

Source: 2022 Analyst & Investor Conference

AI, Rather Than Causing Disruption, It Helps The Business

They are using Artificial Intelligence and Machine Learning to substantially improve key aspects of their stores and improve their productivity and return: Estimating sales, improving inventory turnover and availability, product visibility at a glance, customer service, and delivery improvements. Web apps and omnichannel should benefit from this tailwind as well, making the purchase experience seamless and faster. This often depends on each geography, and it is good that they implement it.

In a fast-changing world always subjected to technological disruptions, finding these kinds of companies that, despite being affected by new technologies like AI, benefit from them is a good way to decrease future disruption. Modernizing their business, using these kinds of operational improvements will increase their competitive advantages, as the capital needed and know-how are only available to the biggest and most experienced players.

Source: 2022 Analyst & Investor Conference

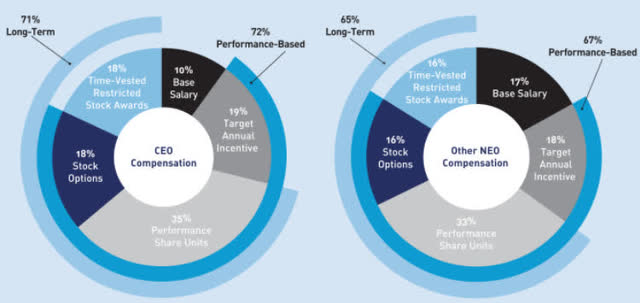

Great Alignment With Management

The CEO is Mr. Marvin Ellison. He has only been there for 5 years, but he spent 12 years at Home Depot (HD) and began his career at Target (TGT), so he has a past in the retail segment and in the specific sector of Lowe’s. Since he arrived, he has made the transition to focus on the PRO segment. He has shares worth almost 50 million and earns 17 million as annual compensation (1.45 million as a base salary). His annual compensation is split as follows: 10% base salary, 71% for long-term objectives (ROIC and TSR), and 19% in annual incentives (40% sales, 40% operating income, 10% inventory turnover, and 10% PRO sales growth). They seem correct to me; I would have liked to see the FCF growth metric, but by combining operating income and inventory management, we can have a good proxy with these two. Also, I really like that they are focusing on sales growth for PRO customers, which, as we have already seen, will be key to long-term growth. Another point that speaks well of the company is that Pershing Square owns 1.74% of the outstanding shares, which means that Bill Ackman has 25% of his portfolio in it.

Competition

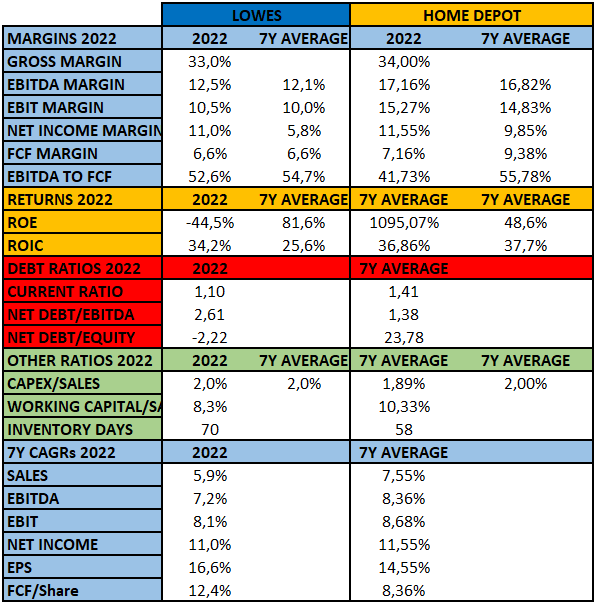

From my point of view, I think Lowe’s has a better run rate of growth than Home Depot. Margins should expand until they reach figures similar to those of its rival, thanks to the optimization of shops, penetration of PRO customers, and cost optimization. The biggest difference between them, could be the number of shops available. While Lowe’s operates around 1700, HD has 2300, and they have not opened any since 2008. This is the new phase in which Lowe’s wants to enter (not opening new stores while optimizing the existing ones), but if the strategy does not go as planned, they will always have margin to open new ones. Moreover, the capital allocation of Lowe’s has proven to be superior, as the timing of stock repurchases has been much better in the former, accelerating while the stock price is depressed and decreasing it while it is overvalued.

Source: Author’s representation

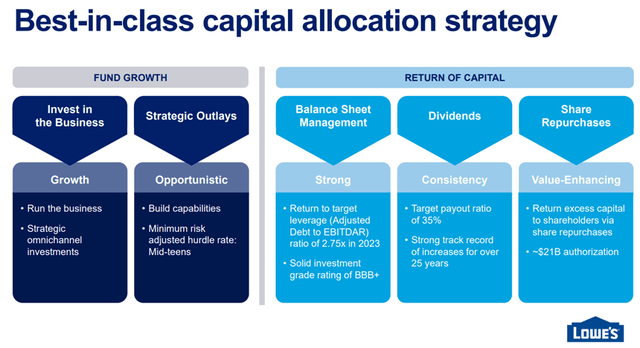

Capital Allocation

Lowe’s has been repurchasing their own shares aggressively during last years. From 2016 to 2022, they repurchased 29% of the company’s shares, and they still have around $21B authorized for buybacks (17% of the company’s market cap).

Dividends: Lowe’s is a Dividend King, increasing its dividend for 57 years in a row. It has a 39% average payout ratio, has grown at a rate of 17.33% above the EPS, and represents a yield of 1.87%. I think they still have enough margin to raise the payout (50% HD payout), but they don’t because they still see a lot of re-investment opportunities in their business. This may change now that the debt targets have been reached and repurchases are a bit paralyzed. The average reinvestment rate has been an incredible 38% with a ROIC close to 40%, so the combination can hardly be improved.

During the 2022 annual conference call, management said they did not care to raise debt to levels of 2.75X net debt EBITDA. They are funded at 3.5% on average with a BBB+ rating at a fixed rate. If we take into account the debt, at $211, Lowe’s trades at 19x PER; if not, we stay close to 15x. (Slide 116)

Source: 2022 Analyst & Investor Conference

Financials

Almost all of its metrics have shown positive performance and improvements. This is what we should look for when investing in quality companies: a positive evolution of the business over time, often showing that their competitive advantages are widening.

Source: Author’s representation

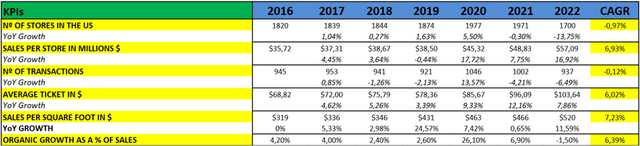

After a great performance during the pandemic years (people were confined at home, so home improvement boosted sales and profits a lot, combined with a great surge in the online channel), growth rates are coming back to normal levels.

We can check this using the KPIs of the company.

Source: Author’s representation

Valuation

I think that Lowe’s is at a good moment with many secular growth trends, supported by being a one-stop shop for its customers and with the transition towards PROs. All these should be reflected in growth rates above its market, around 6%-7%, and combined with a margin improvement (explained in the PRO part) and a good capital allocation from management (repurchases + dividends), I do not see many problems for achieving double-digit growth in the bottom line.

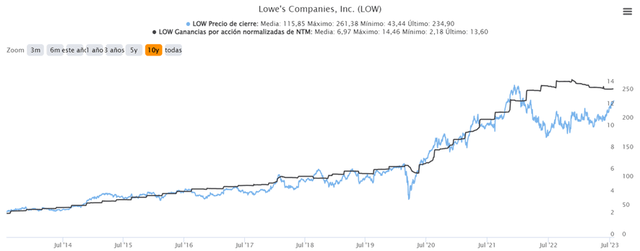

According to TIKR, the market is valuing it below 17x PE multiple, almost in line with its 10-year average. Thanks to all the catalysts explained above, a 20x PE multiple could be justified, but I prefer to be conservative in my valuations.

If we conduct an inverse DCF, we can infer that the market is expecting an 10.5% CAGR in FCF, with a 10% WACC and 3% TGR. Price targets based on a FCF/share basis applying an 18x multiple are also displayed.

I believe that the CAGRs that the valuation demands are reasonable and that they could even be exceeded, especially if we take into account that during the last 7 years, the FCF/share has grown at a CAGR of 12.4%. That is why I rate the stock as a buy.

Source: Author’s calculation based on data from Seeking Alpha

Other important graphs

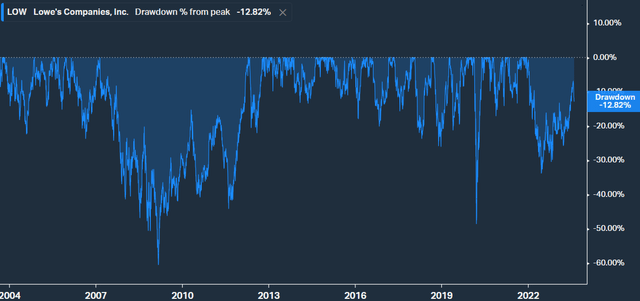

In 2008, it fell by 60%. During 2020, the drop was almost 50%, and at last year’s lows, it fell below 30% from all-time highs. Drawdowns of 20-25% are not entirely rare, and here is where opportunities are generated. As of this writing, the stock is trading at $220 and is 12.8% off all-time highs.

During the last 10 years, Lowe’s has outperformed HD and the S&P 500 by a good margin. I expect this to continue in the future.

In the long run, EPS and price tend to converge. The gap had significance not so long ago, and it is still open. We can monitor this graph in order to identify future opportunities.

Risks

Lowes operates in a sector in which there are intrinsic risks, despite all the tailwinds we have seen above.

Dependence on the US and international expansion. Nowadays, 100% of sales come from the United States, so it is highly dependent on the American economy. For example, if the US enters a recession, home purchases, renovations, and repairs are likely to come to a standstill until the economy improves. This may cause Lowe’s profits to suffer, as occurred in 2009 (-19.9%) and 2010 (-18.7%).

Lowe’s does not have an international presence. This is a good way of diversifying geographical risks, as explained above. In fact, in 2022, it sold its stake in its Canadian business, which represented 6% of sales that year. It is true that its main competitor does not have a large international presence either (88% of sales come from the US), but they already have a presence in Canada and Mexico. This will complicate a future expansion into these countries by Lowe’s, as it will have to compete against its scale there as well.

Business cyclicality. Lowes is exposed to the economic cycle, affected mainly by mortgage interest rates. The higher mortgage interest rates, the lower the number of mortgages granted and the higher the chances of defaults. Nowadays, according to management, 2/3 of the sales are not discretionary. The resilience of the business should improve as PRO customers continue to grow, implying the benefits mentioned above, so this risk should decrease over time. In the meantime, HD may be more resilient to economic cycles, as their revenue is split equally between PRO and DIY customers.

Conclusion

Although it is not an industry with the greatest growth ahead of it or the strongest fundamental macro-trend, we can expect bottom-line double-digit growth, boosted by maintaining a good cost structure and continuing to work towards PRO customer transition; margins should improve somewhat. The good capital allocation made by management in the form of share repurchases and dividends will definitely help as well. I think that Lowe’s could represent a good long term investment opportunity. It is now trading at a slight discount to its fair value, which is why I rate it a buy. Although if we want to have a higher margin of safety, buying it for around $190-$200 might be the best option.