PM Images

There are many insurance companies, but the quest to find ones that keep growing and maintain underwriting profits can be tricky. Thankfully, we find one such company in Kinsale Capital Group (NYSE:KNSL). With an impressive track record, I’ll go over what they do, why they do it well, and why the price is right, making it a solid Buy.

Financial History

Founded in 2009, it’s not quite as established as some legacy names, but that hasn’t hurt its ability to build a strong book of business.

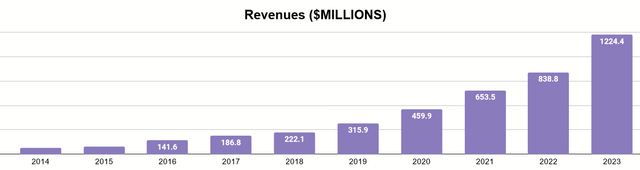

Over the past decade, revenues from $63 million to over $1.2 billion. That’s very impressive growth, but let’s also look at how earnings grew.

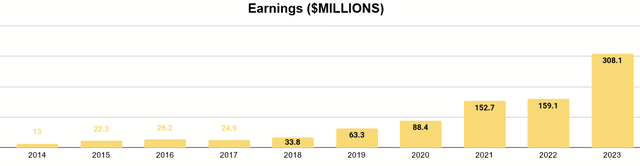

It’s a similar trend of impressively high growth. Every year is profitable, and except for 2017 it’s always higher than the previous year. Still, this alone does not speak to the underwriting.

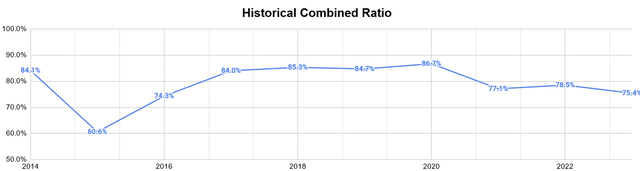

Seen here, Kinsale has blown underwriting out of the water. Their combined ratio is not only consistently in the money, but it’s been below 90% for the whole decade and below 80% for half of it.

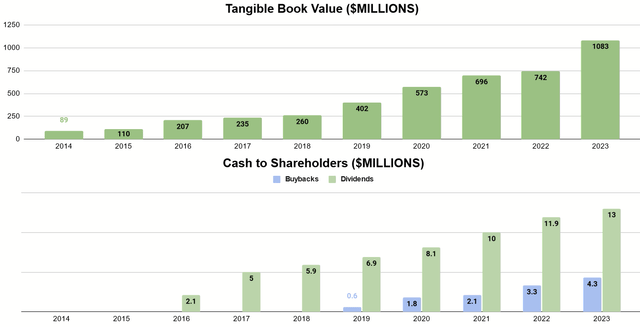

To look at how they’ve been treating capital allocation, most of their earnings have been retained and led to stellar growth of their tangible book. In the lower chart, we see that only small dividends began to be paid in 2016 and even less in buybacks in 2019. With hundreds of millions now in earnings, these are a drop in the bucket and indicate the comfort management has had with reinvesting for growth.

Business Model

We still need to make sense of these numbers and understand how and why Kinsale has managed to pull it off.

To start, it can be simply expressed by their narrow focus: Kinsale offers excess and surplus lines of property-casualty insurance to American customers, without venturing into anything else. This has allowed them to focus on doing a single thing very well and to scale it.

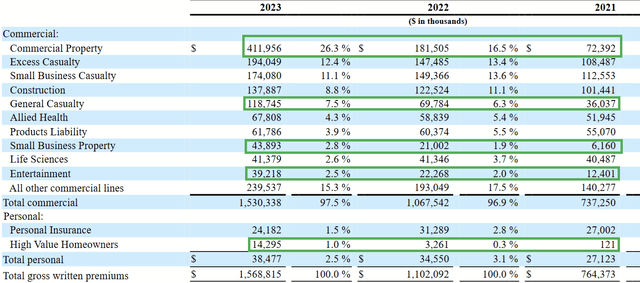

Seen above, they have a variety of lines under the E&S umbrella. The biggest contributor to 2023’s gross premiums written was commercial property, but we can see that that was not so in 2021. I indicated the areas that saw more pronounced growth from 2021 to 2023, just to illustrate how well they are able to launch new lines while maintaining their low, business-wide combined ratios.

March 2024 Company Presentation

Being a younger insurance company, they were quick to appreciate the advantage of having a tech-driven method of accumulating customer and insurance data for analysis and then simply underwriting their policies with strict adherence to those insights. In their 2023 Form 10-K (pg. 6), management mentions:

Kinsale does not grant its independent brokers any underwriting or claims authority. We select our brokers based on management’s review of the experience, knowledge and business plan of each broker. While many of our brokers have more than one office, we evaluate each office as if it were a separate brokerage and may appoint some but not all offices owned by a broker for specialized lines of business. We seek brokers with business plans that are consistent with our strategy and underwriting objectives. Our underwriters regularly visit with brokers in their offices in order to market and discuss the products we offer.

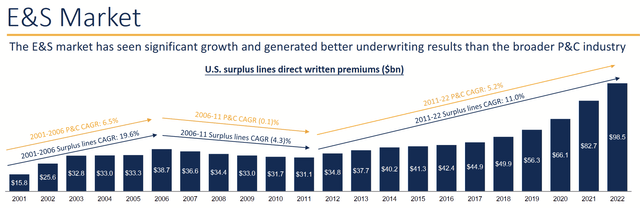

I believe this is the driving factor that explains their high rate of growth over the decade while still underwriting profitably. Much of this can also be explained by the fact that they have been serving a rapidly growing market as well.

March 2024 Company Presentation

Seen above, the company, starting in the pit of the Great Recession, has been riding a positive, secular wave, while keeping to standards.

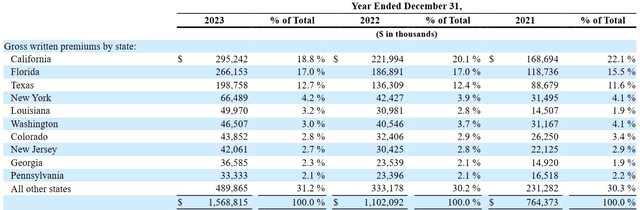

Working entirely in the United States, we see that business is concentrated among the most populous states, with California, Florida, Texas, and New York accounting for about half of 2023’s gross written premiums. Kinsale also notes that most of these customers are small-to-mid-sized business, with whom they enjoy less competition and better pricing (2023 Form 10K, pg. 3).

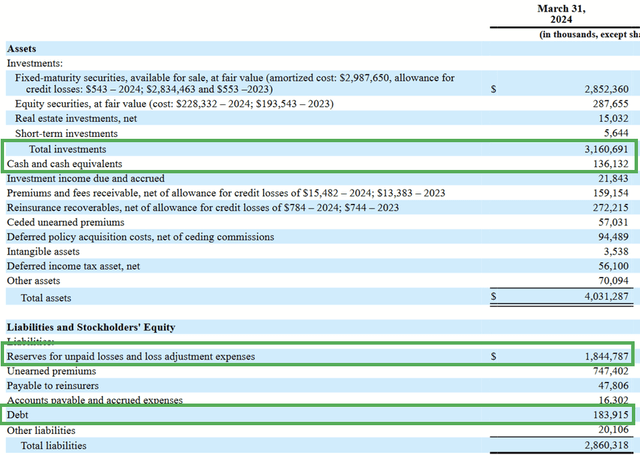

Balance Sheet (Q1 2024 Form 10Q)

The balance sheet is also very healthy, with total cash and investments well in excess of their insurance liabilities and debt.

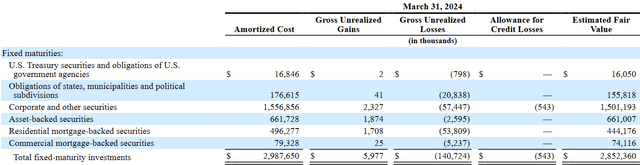

Fixed-Maturity Portfolio (Q1 2024 Form 10Q)

Nearly all of the investments are in fixed-maturity debt securities, most of which are corporate bonds, the other two largest portions being ABS and MBS issues. They are less concentrated on Treasuries than many other insurance companies I’ve seen. That may concern some, but overall investment income is a small portion of the value here.

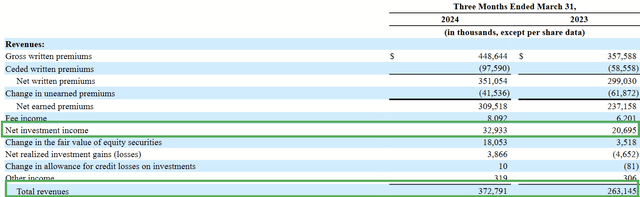

Net investment income is typically only 10% of revenues or less. For many insurance companies, their ability to be profitable depends on net investment income carrying them over the edge, but Kinsale doesn’t need to worry about that.

Future Outlook

I think the first thing to mention is that I believe that growth will continue to occur, but that it will be balanced with the same discipline the company has always practiced. CEO Michael Kehoe elaborated on this in Q1 earnings, when discussing the future of their property line:

I would say that property pricing is probably at a 20-year high and as we said in our prepared remarks, we see that as a very attractive opportunity for growth. We’re always going to prioritize profitability over growth. So, depending on where the market trends in the future, we’ll probably have a lot to do with how rapidly that line of business grows.

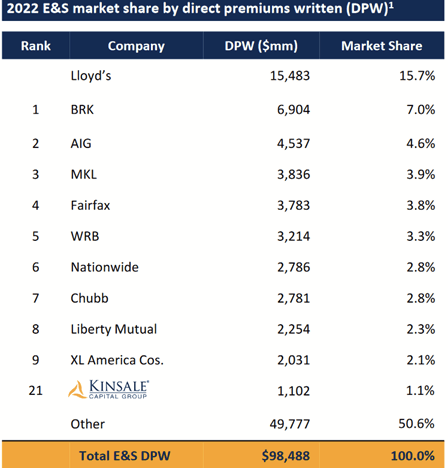

As the E&S market continues to grow, they can still ride that while maintaining their current market share, and there is also room to grow their share too.

Q1 2024 Company Presentation

In 2022, the company had about 1.1% of the American E&S market. They’ve since continued to grow that. Kehoe explained some of this in Q1 earnings:

In the first quarter of 2024, Kinsale’s operating earnings per share increased by 43.4% and gross written premium grew by 25.5% over the first quarter of 2023. For the quarter, the company posted a combined ratio of 79.5% and it posted an operating return on equity of 28.9%. The company’s strategy of disciplined E&S underwriting and technology enabled low costs drive these results and allows us to generate attractive returns and take market share from competitors at the same time.

With the attractive economics, and a history of capturing share, I believe this trend will continue over the course of the next decade. Related to these points, COO Brian Haney also had to say:

We don’t have to have a 30-ish ROE to maximize book value. So in certain areas, we are looking at cutting rates to grow faster. In certain areas in some of the calendar lines we don’t need to do that because we’re growing fast enough as it is. So yes, division by division we’re looking at that exact calculation regularly. And again…the goal is to drive as much value to the company and the investors as we can.

But there is definitely room and you’re right. Being a low cost operator provides us a leeway I think that our competitors don’t have.

As a pure play on E&S, I think it can even overtake some of the more popular names seen in the rankings above, even it’s not their market share that they take. There’s another 50% of the market, consisting of smaller players, that they can outperform to do that. If we imagine steady growth of the E&S market and their share getting to 5% or 6%, then earnings could easily be a few multiples of what they are today.

Capital Allocation

As I mentioned before, very little of earnings are committed to buybacks or dividends at this moment in time. As the company grows and reaches market saturation comparable to that of the big names, they may find that they can’t maintain their conservative standards while continuing to grow at previous rates. Thus, they would be forced to consider what to do with their extra capital, as I believe them when they say they won’t use it to underwrite risky policies.

Based on what I said about potential growth, 2023’s $303M in earnings could be anywhere from $500M to $1B within a few years. Currently, their dividend payout ratio is 4.2%. There’s room for them to grow this and to make it one of the primary ways that value is returned to shareholders. The same could be done with buybacks, and the benefit of that will be much more price-dependent. Thus, these developments could be future risks or reasons to celebrate and are worth monitoring over time.

Valuation

Normally, for an insurance company, I would take the tangible book value and add to it the next decade’s discounted earnings. For Kinsale, where earnings and growth are the story, I think the PEG-ratio is a better method to value this company.

With EPS growth averaging 29% over the last five years, and the forward P/E being 25.77 as I write this, I think the current price of KNSL around $396 is attractive for a grower.

P/E Ratio 5Y History (Seeking Alpha)

Moreover, if we look at the P/E ratio today compared to those same five years, this is about as reasonable as the multiple has ever been. That said, if the multiple begins to expand well into the 30s, that’s when I’d be more skeptical about buying. At that point, an investor risks disappointingly low returns and potentially even losses if the multiple contracts.

Conclusion

Kinsale has delivered on its founding mission to underwrite E&S insurance products not only profitably but with a history of combined ratios that are the envy of most insurance companies. With more growth ahead and an eye to the optimal balance between ROE and expansion, the foreseeable future is optimistic. Long-term investors should keep in mind how Kinsale’s market saturation could slow the growth and affect their strategy for capital allocation. Will they still like it with a spike in dividends and/or buybacks?

Yet, it’s hard to turn away an attractive multiple for what the prevailing growth rates have been for such a solid business. To me, the shares have all the right signs of being a textbook Buy.