HJBC

Year-to-date, the STOXX Europe 600 Insurance is up by 8.5% and has delivered a total return, including dividend payment, of almost 12.1%. Looking back, in 2022, we reported how AXA SA was our Favorite Insurer (OTCQX: AXAHY, OTCQX: AXAHF), and YTD, the company confirmed its best-in-class return story, delivering a total performance of 13.75%. Here at the Lab, we believe there will likely be more upbeat within the sector into 2024. Despite a positive stock price performance, European insurers were impacted by a declining premium due to higher risk-free yields; in addition, within the sector, IRS17 regulatory requirements had a mixed impact on earnings, and if we add credit risk concerns, the picture was not ideal. However, looking ahead, we remain positive on European insurance and, more importantly, with AXA investment. At the single entity level, this is based on four key themes:

- Balance sheet and scale: With inflation and higher interest rates for longer, insurance barriers to entry are more elevated. Competition will be lower, with smaller and new players having difficulties entering a market that requires significant investment in regulations and more needed technology investments. AXA’s past investment to enhance efficiency with automation in claims and a capillary distribution are key value drivers that cannot go unnoticed. In addition, GEO and earnings diversification pays off within the industry. We also believe that the company has M&A upside optionality supported by an anticipated acceleration of market consolidation. We believe AXA is best positioned to take advantage of this current environment;

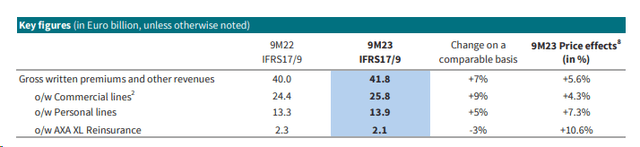

- Higher revenue generation: Here at the Lab, we expect a 5% increase in the global P&C industry. Therefore, top-tier players like AXA are better positioned to increase market share penetration. Going to the Life division, personal lines pricing activities are now accelerating. We should also consider the favorable combination of AXA Benefitting From XL’s Lower Risks and reinsurance favorable pricing dynamic, likely continuing through 2024. As a reminder, in the first 9months, XL reinsurance pricing was up by 10.6% (Fig 2). In our forecasted numbers, our pre-tax operating income reached €10 and €10.8 billion in 2023 and 2024, with an adjusted net profit of €7.7 and €8.4 billion;

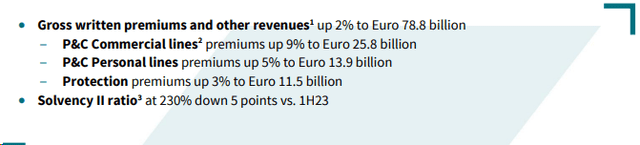

- Remuneration story: More substantial balance sheets mean potentially higher shareholders’ remuneration combined with capital rights allocation priorities. We forecast an unchanged flat solvency ratio through 2024; it is an already elevated level (in Q3, the AXA solvency ratio was at 230% – Fig 1). Indeed, the company is not only a safer investment, but its stronger balance sheet will allow AXA to withstand potential market weakness and provide options for growing capital returns payout. A possible 100 basis point EU yield reduction might impact AXA’s solvency ratio; however, the company is already well-capitalized, and we believe in a higher-than-expected payout story. The company also reiterated its commitment to evaluate disposal, and we think that Wall Street will likely appreciate any further news on the matter. We continue to see AXA’s earnings above €7.5 billion guidance, and for the above reason, if acquisitions are not in place, we might expect a buyback while growing the DPS (7% per year). Here at the Lab, we forecast a dividend of €1.82 and €1.95 in 2024 and 2025, respectively.

-

Combined ratio: With IFRS17 implementation, earnings sensitivity to lower yields should be limited. This and a favorable combined ratio dynamic make AXA a profitable growth story. Our estimates show higher net profit results thanks to a positive combined ratio development. In numbers, we implied a ratio of 91% in 2023 and 90.5% in 2024.

AXA solvency Ratio

Source: AXA press release – Fig 1

AXA XL results

Fig 2

Conclusion and Valuation

As we analyzed in March with a publication called AXA, which had an Immaterial Exposure To Credit Suisse AT1 Bonds, there are negative rumors about EU insurance exposure to Signa’s financial troubles. AXA did not comment, but from the news, we believe German insurers are involved. With IFRS17 earnings momentum, we forecast an EPS growth story trajectory for AXA (+8.5% vs a +6% sector average). This is supported by reinsurance margin expansion and pricing dynamic, asset management recovery, and life division attractiveness. We are beyond the bond yield peak, and our outlook on credit spreads is muted with a continuing price increase in the P&C division; we believe AXA is set to deliver superior returns. In this context, the company is our top pick for improving bottom-up fundamentals. At the aggregate level, the sector trades on a 2024 P/E of 10.5x and a dividend yield of 5.7%. Looking back, the insurance sector’s long-term average range was 9.5-11.5x P/E and 4-6% dividend yield. AXA trades at the bottom quartile, and we believe this is not justified. The company’s implied 2024 P/E is only 8.16x. AXA 2023 and 2024 EPS are at €3.45 and €3.78 in 2023 and 2024, respectively. Therefore, valuing AXA with a 10.5x P/E (in line with the sector), we arrived at a price target of €36.22 per share ($39 in ADR) (our previous buy rating was at €31 per share). The company’s dividend yield is also higher (6% vs. 5.7%). Downside risks include lower capital position due to macroeconomic drivers like inflation, interest rates, and equity market movements. On a standalone basis, AXA might be affected by inflation claims and natural catastrophes. This could lead to lower margins and significantly reduce the company’s earnings.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Unlocking the Potential: AXA’s Exciting Outlook for 2024 (OTCMKTS:AXAHF)

In today’s fast-paced digital world, it’s essential for businesses to constantly adapt and innovate to remain competitive. The insurance industry is no exception, and leading insurance company AXA is no stranger to this reality. As we look to the future, AXA’s exciting outlook for 2024 (OTCMKTS:AXAHF) is filled with potential and growth. In this article, we’ll take a closer look at what this means for the company and investors, along with the key factors driving AXA’s success.

A Brief Overview of AXA

Before we dive into the exciting outlook for 2024, let’s first take a look at AXA and what makes it a global leader in the insurance industry. Founded in 1817, AXA is a French multinational insurance company with a presence in over 50 countries and serving over 108 million customers. The company offers a range of insurance products, including life, health, property, and casualty insurance.

In addition to its insurance offerings, AXA also provides financial services, such as investment management and retirement planning. With a strong focus on innovation and digitization, AXA has become a market leader in the insurance industry, continuously adapting to the ever-changing needs of its customers and the business landscape.

Current State of AXA

Despite the challenges of the COVID-19 pandemic, AXA has continued to remain resilient and has shown promising growth in recent years. In 2020, the company reported a total revenue of 96.3 billion euros, a 3% increase from the previous year. Furthermore, AXA’s underlying earnings saw a solid growth of 2% to 6.2 billion euros.

The company has also been actively diversifying its business portfolio, with its acquisition of XL Group in 2018, a global commercial property and casualty insurer. This move has expanded AXA’s presence in the United States and enabled it to further strengthen its position as a leading global insurer.

AXA’s Exciting Outlook for 2024

As we look ahead to 2024, AXA is set to continue its promising growth trajectory and unlock its full potential. The following are the key factors that will contribute to AXA’s exciting outlook for 2024:

1. Digitization and Innovation

AXA has been heavily investing in digital transformation and innovation to enhance customer experience and improve operational efficiency. The implementation of new technologies, such as artificial intelligence and data analytics, has enabled the company to better understand its customers’ needs and provide personalized solutions.

In 2024, AXA’s digital initiatives are expected to drive significant growth, reaching a target of 5 billion euros in revenues. This will not only strengthen AXA’s competitive edge but also increase its reach and relevance in the market.

2. Focus on Emerging Markets

In addition to its strong presence in Europe and the United States, AXA has also been expanding its operations in emerging markets. With a growing middle class and increasing awareness of insurance, these markets present significant growth opportunities for the company.

In the next few years, AXA plans to leverage its digital capabilities and expertise to increase its footprint in Asia, including Vietnam, Indonesia, and China. This will not only boost AXA’s revenue but also enable it to tap into a diverse customer base and strengthen its global presence.

3. Sustainable and Responsible Investing

AXA has a strong commitment to sustainability and responsible investing and is focused on integrating environmental, social, and governance (ESG) factors into its investment decisions. This approach not only supports sustainable growth but also aligns with the changing consumer sentiment towards socially responsible investments.

Looking to 2024, AXA plans to invest a significant portion of its assets in ESG strategies and green projects. This not only benefits the environment but also attracts socially responsible investors and strengthens AXA’s reputation as an ethical and responsible company.

4. Strong Financial Performance

AXA’s resilient financial performance serves as a testimony to the strength of its business model and growth potential. The company is committed to maintaining a solid financial position and has set ambitious financial targets for 2024, including a return on equity of 14% and an underlying earnings growth of 3-7%.

With a strong focus on cost efficiency and risk management, along with an extensive product portfolio and digital capabilities, AXA is well-positioned to achieve these targets and unlock its full potential in the coming years.

In Conclusion

AXA’s exciting outlook for 2024 presents a compelling opportunity for both the company and its investors. With a strong commitment to innovation, expansion in emerging markets, sustainable investing, and a solid financial performance, AXA is set to thrive in the future. As the company continues to unlock its potential, it will further solidify its position as a global leader in the insurance industry, providing value to its customers, employees, and shareholders. Keep an eye on AXA as it continues to break boundaries and reach new heights in the next few years.