imaginima

The ClearBridge MLP and Midstream Total Return Fund (NYSE:CTR) is a closed-end fund that aims to provide investors with a very high level of current income and total returns. Midstream companies and especially master limited partnerships generally deliver a very high percentage of their total returns to investors in the form of direct payments made to their owners. This, combined with the generally low growth and low earnings multiples of most midstream typically results in these companies having higher yields than many other things in the market. As this fund distributes its income to its shareholders, this results in it having a respectable 7.47% yield at the current price. This is clearly higher than the 1.36% current yield of the S&P 500 Index (SPY), although it is not as impressive as the 7.87% trailing yield of the Alerian MLP Index (AMLP). Thus, we see the same problem here that we see with many of the midstream closed-end funds – their yields are worse than a comparable market index. With that said, this fund is able to invest in things other than midstream partnerships, so it does have a bit more flexibility than the comparable indices. The ClearBridge MLP and Midstream Total Return Fund is also one of the few ways to easily add midstream partnerships to a retirement or other tax-advantaged account, so it has that going for it.

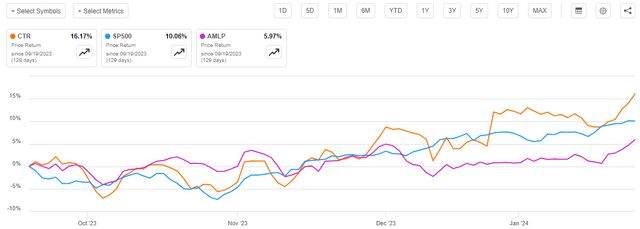

As regular readers may recall, we last discussed the ClearBridge MLP and Midstream Total Return Fund in mid-September 2023. The fund’s share price performance since that time has been quite impressive, as it has appreciated by 16.17% compared to a 10.06% gain in the S&P 500 Index (SP500). The fund’s share price performance has also greatly outstripped that of the Alerian MLP Index:

Seeking Alpha

This strong performance is almost certainly going to appeal to most investors, including those who are focused on the generation of income from their assets. After all, the fund’s yield is not really that much lower than the Alerian MLP Index, and the much stronger recent performance easily makes up for the slightly lower income.

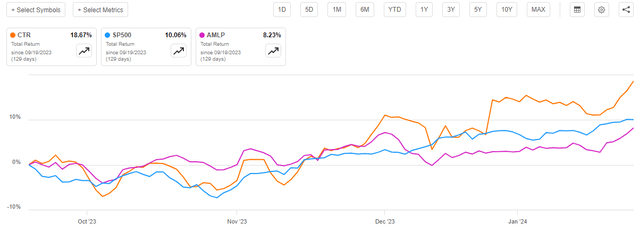

As I have pointed out in numerous previous articles, it is somewhat misleading to look solely at the share price performance when evaluating a closed-end fund such as the ClearBridge MLP and Midstream Total Return Fund. This is because these funds tend to deliver a substantial percentage of their total return in the form of direct payments to the shareholders. Indeed, the basic business model for these entities is to pay out all of their investment profits to their shareholders while attempting to keep their net asset value at a relatively stable level. As such, the actual returns that investors realize will almost always be substantially higher than the price performance alone would suggest. This is certainly the case for this fund, which has delivered an 18.67% total return since the last time that we discussed it. This is still much better than either of the indices, even when we consider that the Alerian MLP Index also delivers a significant proportion of its total return in the form of direct payments to the shareholders:

Seeking Alpha

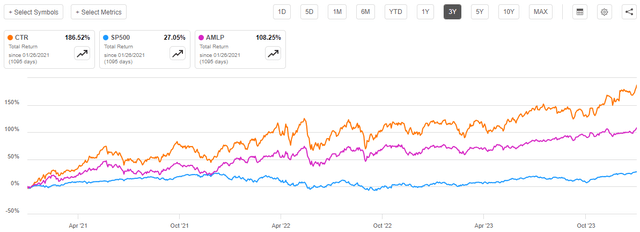

This is very nice to see, and it certainly speaks well for the quality of this fund’s management, at least in recent years. As was the case with most midstream closed-end funds, this one does underperform both the Alerian MLP Index and the S&P 500 Index if we go back far enough to include the collapse in midstream stocks that accompanied the COVID-19 pandemic. However, it is still substantially above both indices over the past three years. As we can see here, the ClearBridge MLP and Midstream Total Return Fund delivered a 186.52% total return over the past three years:

Seeking Alpha

Thus, the fund’s recent performance certainly looks impressive, but as we all know, past performance is no guarantee of future results. As such, we should still investigate the fund before just blindly buying it. There have been a few changes to this fund since the last time that we discussed it, including the release of a more recent financial report, so let us proceed with an updated discussion.

About The Fund

According to the fund’s website, the ClearBridge MLP and Midstream Total Return Fund has the primary objective of providing its investors with a very high level of total return. This makes sense when we consider the strategy that the fund employs in pursuit of this stated objective. Here is how the fund’s fact sheet explains its investment strategy:

Offers a total-return oriented portfolio of primarily energy master limited partnerships (MLPS) and midstream entities. Provides the opportunity for attractive, “tax-deferred” distributions with a combined emphasis on capital appreciation. Targets companies with the potential to grow their businesses and distributions over time.

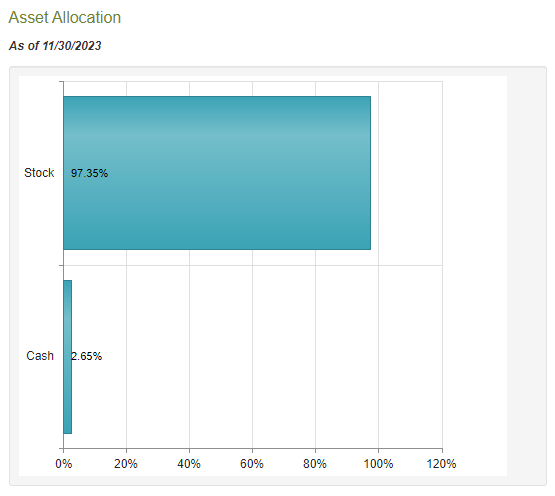

Unlike most funds, this one’s strategy description does not explicitly state whether it is investing in common equity in debt. However, most closed-end funds that invest in the midstream sector do so by purchasing common equities of midstream corporations and partnerships. In some cases, they might also include preferred equities issued by such companies, but this is not often seen. Indeed, I can only think of one or two midstream funds that include both common and preferred stock. For its part, the ClearBridge MLP and Midstream Total Return Fund is entirely invested in common equity except for a 2.65% allocation to cash:

CEF Connect

This is similar to the asset allocation that the fund had the last time that we discussed it. It did slightly decrease its cash position in favor of more common equity though, but the difference was negligible. Indeed, this variance might have been simply caused by the specific timing of when the fund received a cash dividend or distribution from some of the assets in its portfolio and when it made a payment to its own shareholders. It is not something that we need to worry too much about, as we generally want a common equity fund to be as fully invested as is reasonably prudent.

Midstream companies do frequently issue preferred stock or partnership units as a method of financing their growth projects. It is extremely expensive to construct a pipeline, terminal, or similar infrastructure project. Historically, midstream companies have struggled to finance these projects internally, so they have relied on external financing. This has become somewhat less common recently due to a few factors, including two industry collapses in the past decade and a general aversion of many investors to financing oil and gas projects, but there are still some companies that have outstanding preferred stock issues. This is why we might occasionally see a preferred stock allocation in a midstream. As I explained in my previous article on this fund though, it generally does not make sense to purchase preferreds issued by a midstream company:

The high yield of the common equity in many cases gives master limited partnerships a higher yield on the common equity than on the preferred. In such an environment, it makes no real sense for a fund seeking total return to purchase the preferred equity over the common equity. After all, the common equity has a higher yield and significantly better capital gains potential so it will almost always be the higher returning investment. The only real reason to purchase the preferred is that the preferred equity will be less volatile than the common equity. This could be advantageous during certain circumstances but generally, the common equity of midstream companies is reasonably low volatility. In addition, the preferred equity is theoretically safer in a bankruptcy or forced liquidation scenario. However, in most bankruptcy situations, the assets of the company are insufficient to cover all of the debt so both the common unitholders and the preferred investors will get wiped out. Additionally, I doubt very much that most people who want to buy a midstream fund are expecting to invest in companies that are threatened with bankruptcy! Thus, there is no real reason for a fund like this to purchase anything except for the common equity of midstream companies.

Thus, the fund will generally be able to derive a higher income and a much greater potential for capital gains by investing in the common equity issued by midstream companies. The fund’s management appears to agree with this, as we can clearly see above.

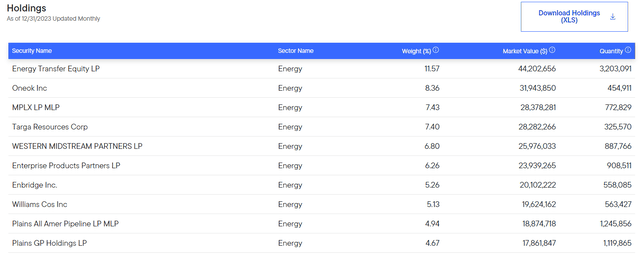

As long-time readers are no doubt well aware, I have devoted a considerable amount of time and effort over the years to discussing midstream companies and partnerships here and on the main Seeking Alpha site. As such, the largest positions in the fund will likely be familiar to most investors. Here they are:

Franklin Templeton

We can see a number of changes to this list since the last time that we discussed the fund. In particular, both Magellan Midstream Partners and Antero Midstream (AM) have been removed from the fund’s largest positions. In their place, we see ONEOK (OKE) and Enbridge (ENB). The swap of Magellan Midstream Partners for ONEOK makes a great deal of sense, as the two companies merged back in late September 2023. ONEOK was the surviving company and anyone holding Magellan Midstream’s common units would have received common stock in ONEOK on the date that the deal was completed. Thus, the fund probably received some shares of ONEOK from that event and when combined with any shares of ONEOK that it already had resulted in that company becoming the second largest position in the portfolio. The replacement of Antero Midstream with Enbridge was a bit more surprising, but admittedly Enbridge does have a somewhat better reputation among investors. We can see that simply by looking at the tone of the Enbridge articles posted on Seeking Alpha when compared to the tone of Antero Midstream articles. Indeed, I think that I am one of the only analysts who criticizes Enbridge to any great degree and that is simply because it has a very high debt load relative to its peers. At least so far, the company’s high debt load has not been a significant problem for it though. Thus, I cannot say that I have any real problem with the fund’s portfolio right now, as most of the companies that comprise the largest positions are among the largest and strongest companies in the industry.

The two changes just mentioned were the only additions or removals to the fund’s largest positions list over the past four months. However, the weightings that each position represents in the fund’s portfolio have changed significantly. For example, Targa Resources (TRGP) was the second-largest position in the fund the last time that we discussed it. Obviously, it is now the fourth-largest position, although its actual weighting has only gone from 7.55% of total assets to 7.40%. This could simply be caused by one company outperforming another in the market, although the weighting changes that we see can also be caused by the fund actively making changes to its portfolio in order to adjust its weightings. The fund only had a 43.00% annual turnover during the twelve-month period that ended on November 30, 2023, which is less than many of its midstream peer funds. This suggests that the fund is not doing a substantial amount of trading to make adjustments to its portfolio, so many of the weighting changes that we see here are probably just caused by market fluctuations. This is not necessarily a bad thing, as reduced trading activity helps to keep the fund’s costs down overall. That should, in theory, mean that more money is available to deliver returns to the shareholders.

Leverage

As is the case with most closed-end funds, the ClearBridge MLP and Midstream Total Return Fund employs leverage as a method of boosting the effective total return of its portfolio. I have explained how this works in a number of previous articles on other closed-end funds. To paraphrase myself:

Basically, the fund borrows money and uses that borrowed money to purchase the common equity of midstream energy partnerships and corporations. As long as the total return that the fund receives from the borrowed money is higher than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the total return of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will usually be the case.

However, it is important to note that the use of leverage is a less effective method of boosting total returns today than it was a few years ago. This is because a 6% borrowing rate has substantially reduced the difference between the total return that the fund can receive and the interest rate that it has to pay on the borrowed money compared to when interest rates were basically zero.

The use of debt in this fashion is a double-edged sword. This is because leverage increases both gains and losses. This is the big reason why midstream closed-end funds were generally decimated by the industry collapse back in 2020. As such, we want to ensure that the fund does not employ too much leverage because that would expose us to an unacceptable level of risk. I generally do not like a closed-end fund’s leverage to exceed a third as a percentage of its assets for this reason.

As of the time of writing, the ClearBridge MLP and Midstream Total Return Fund has leveraged assets comprising 26.95% of its portfolio. This is reasonably in line with the leverage that other midstream closed-end funds employ, so it does not appear that we need to worry too much about the fund’s leverage right now. This fund does not appear to be excessively leveraged.

The balance between risk and reward is reasonable here, although more risk-averse investors might want to keep an eye on the fund’s leverage. After all, leverage has caused a lot of damage to midstream funds over the past decade. As such, some investors might feel more comfortable if the fund keeps its leverage at a low level and does not increase it to the 30% to 40% range that we have been seeing broad-market equity funds run recently.

Distribution Analysis

One of the biggest reasons why investors purchase shares of midstream companies is that they tend to have higher yields than companies in most other sectors. In addition, midstream companies tend to have fairly stable cash flows to support their distributions, which is nice for retirees or others who want a secure source of income. The ClearBridge MLP and Midstream Total Return Fund invests in these companies, so it collects the distributions paid by the stocks and partnership units on behalf of its investors. It pools this money together with any realized capital gains that it manages to achieve. The fund even uses leverage to allow it to collect both distributions and dividends as well as capital gains from more assets than it could control solely using its own equity capital. The fund then pays all of this money out to its shareholders, net of its own expenses. When we consider the yields paid by these companies, as well as the potential capital gains, we can assume that this strategy will give its shares a very high yield.

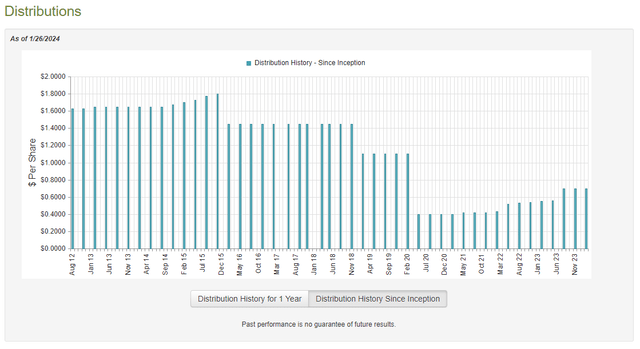

This is certainly the case, as the ClearBridge MLP and Midstream Total Return Fund pays a quarterly distribution of $0.70 per share ($2.80 per share annually), which gives it a 7.47% yield at the current price. This is slightly lower than the Alerian MLP Index, but it compares pretty well to the yield offered by most common stock indices. Unfortunately, this fund has not been particularly consistent with respect to its yield over the years. As we can see here, the fund cut its distribution a few times over the 2015 to 2020 period, but it has since begun to increase it:

CEF Connect

This distribution history might prove to be a turn-off for those investors who are seeking a source of stable and consistent income to use to pay their bills or finance their lifestyles. However, it is not really out of line with the distribution history that we have seen from peer funds. After all, the midstream industry went through two very challenging periods during the time span shown above. In both periods, general investor aversion to anything connected to fossil fuels and low energy prices caused the industry to hand losses to investors and make reforms to the general business model. This causes problems for any sort of leveraged investment, and the fund naturally had to make cuts in order to avoid having the distributions destroy its net asset value. Fortunately, the sector has improved considerably since the pandemic, as many companies are now entirely self-financing and growth spending has been scaled back. This may have a negative effect on energy supplies going forward, as we have discussed in previous articles, but it has at least allowed the fund to raise its distributions and help offset the impact that today’s high levels of inflation have been having on all of our wallets.

As I have pointed out numerous previous times though, the fund’s distribution history is not necessarily the most important thing for anyone who is considering purchasing this fund today. After all, a brand-new investor will receive the current distribution at the current yield. This individual will not be affected by actions that the fund took in the past and only needs to worry about the fund’s ability to sustain its distribution going forward. Let us investigate this.

Fortunately, we have a very recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the full-year period that ended on November 30, 2023. This is one of the newest reports that is available from any closed-end fund, and it is also much newer than the report that was available to us the last time that we discussed this fund. This is very nice to see, as this report will give us a much better idea of how well the fund can sustain its current distribution than we had previously. After all, energy prices over the period covered by this report were generally lower than we saw in 2022. Midstream companies are theoretically insulated by energy price changes, but in practice, commodity prices have an impact on the share and unit prices of midstream companies so we should not completely ignore this dynamic. Even in the absence of lower energy prices relative to 2022, it is always nice to have recent information when analyzing a closed-end fund.

During the full-year period, the ClearBridge MLP and Midstream Total Return Fund received $25,925,359 in dividends and distributions along with $369,792 from storing its cash in money market funds. The fund had to pay some money in foreign withholding taxes, which reduced its investment income somewhat. In addition, a sizable amount of the company’s income came from master limited partnerships, so it is not considered to be investment income for accounting purposes. As such, the fund only reported a total investment income of $6,883,757 during the full-year period. This was not sufficient to cover the fund’s expenses during the period, and it ended up with a net investment loss of $10,671,637 over the period. This may be concerning at first glance because the fund obviously did not have sufficient net investment income to cover any distribution, let alone the $17,304,099 that the fund actually paid out in distributions during the period.

However, a fund like this does have other methods through which it can obtain the money that it requires to cover its distributions. For example, it might be able to earn capital gains to offset the net investment loss and pay the distribution. In addition, this fund receives a great deal of money from master limited partnerships that is not considered to be investment income for tax purposes, but it still obviously represents money coming into the fund that can be distributed.

Fortunately, the fund did have a great deal of success at bringing in money from alternative sources. It reported net realized gains of $62,885,913 but this was partially offset by $18,945,649 net unrealized losses during the period. Overall, the fund’s net assets increased by $12,683,776 over the period after accounting for all inflows and outflows (including both the distribution and share buyback). As such, the fund does appear to have fully covered its distributions with a great deal of money left over during the full-year period. This fund’s finances appear to be in pretty good shape, and we should not need to worry about it today.

Valuation

As of January 25, 2024 (the most recent date for which data is currently available), the ClearBridge MLP and Midstream Total Return Fund has a net asset value of $40.20 per share but the shares currently trade for $37.50 each. This gives the fund a 6.72% discount on net asset value at the current price. This is not as good as the 7.41% discount that the fund’s shares have averaged over the past month, so it might be possible to obtain a better entry point by waiting for a little bit. However, the fund is still trading at a discount, so the current price is not horrible.

Conclusion

In conclusion, the ClearBridge MLP and Midstream Total Return Fund is a somewhat underfollowed midstream closed-end fund that overall looks pretty good. The fund easily covered its distribution over the past year, and it trades at a discount on net asset value. While the fund’s yield is slightly below the Alerian MLP Index, it has been outperforming the index over the past few years so it is certainly worth considering right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Unlocking the Potential: How CTR CEF Beats the Index and Offers a Bargain Price

The world of investing can be overwhelming and complex. With thousands of options to choose from, it can be challenging to find the perfect investment opportunity. However, for those looking to unlock the potential of their investments, Closed-End Funds (CEFs) are an excellent choice. Specifically, CTR CEF has been beating the index and offering a bargain price, making it an attractive investment opportunity for those looking to maximize their returns. In this article, we will delve deeper into what CTR CEF is, why it beats the index, and why it offers a bargain price.

What is CTR CEF?

Before we dive into the reasons behind CTR CEF’s success, let’s first understand what a CEF is. In simple terms, a CEF is a type of investment fund that raises money from investors to invest in a portfolio of assets. These assets can include stocks, bonds, and other securities. Unlike traditional open-end mutual funds, CEFs have a fixed number of shares and are listed on stock exchanges like ordinary stocks. This means that their price is determined by supply and demand and can trade at a premium or discount to their net asset value (NAV) per share.

CTR CEF is a specific type of CEF that stands for Closed-End Transportation Fund. It aims to invest mainly in transportation-related companies, such as airlines, railroads, and trucking, to name a few. The fund is managed by Nuveen, a Chicago-based global investment firm with over $1 trillion in assets under management. As of July 2021, CTR CEF’s assets under management totaled $159.9 million, with a current net asset value of $18.75 per share.

Now that we have a better understanding of what CTR CEF is let’s dive into why it beats the index and offers a bargain price:

1. Specialization in the Transport Industry

One of the primary reasons why CTR CEF beats the index is its specialization in the transportation industry. While most funds have a diverse portfolio, CTR CEF’s focus on a specific sector gives it an advantage. The transportation industry has been on an upward trend, with the demand for travel and goods transportation increasing. CTR CEF’s portfolio includes some of the leading transportation companies globally, benefiting from this trend and outperforming the overall market.

2. Active Management

Another reason behind CTR CEF’s success is its active management style. Unlike index funds, which operate passively, CTR CEF’s managers make strategic investment decisions to maximize returns. This active management style allows for strategic buying and selling of assets, taking advantage of market trends and fluctuations. In times of market volatility, this can be particularly beneficial for investors as it can help mitigate losses.

3. Attractive Yield

CEFs are known for their attractive yields, and CTR CEF is no exception. As of July 2021, the fund’s current yield was 9.96%, significantly higher than the S&P 500 index’s average yield of 1.33%. This yield is paid out monthly, giving investors a steady stream of income. This aspect makes CTR CEF an attractive option for income-oriented investors.

4. Trading at a Discount to NAV

One of the most intriguing aspects of CTR CEF is that it consistently trades at a discount to its NAV. As mentioned earlier, CEFs can trade at a premium or discount to their NAV, making them an excellent bargain for investors. As of July 2021, the fund was trading at a discount of 11.35% to its NAV. This discount means that investors can purchase shares of the fund at a lower price than their actual value, potentially resulting in higher returns in the long run.

5. History of Strong Performance

CTR CEF’s track record speaks for itself. Over the years, the fund has consistently outperformed the S&P 500 index and other transportation sector indices. For example, in the last five years, CTR CEF’s average annual return was 12.83%, while the S&P 500 and Dow Jones Transportation Average yielded 14.93% and 13.48%, respectively. This strong performance highlights the fund’s potential and justifies its premium in the market.

In Conclusion

CTR CEF offers investors the opportunity to unlock the potential of their investments through its specialization in the transport industry, active management style, attractive yield, and trading at a discount to NAV. Investing in CEFs, in general, comes with its risks, including market volatility and the possibility of the discount widening. However, for those willing to take on some risk and diversify their portfolio, CTR CEF offers an attractive and potentially lucrative investment option.

Whether you are a seasoned investor or someone looking to explore different investment opportunities, CTR CEF should be on your radar. Its track record of consistently outperforming the market, attractive yield, and potential for capital appreciation make it a bargain at its current price. As always, it is essential to conduct thorough research and consult with a financial advisor before making any investment decisions. With CTR CEF, investors can unlock the potential of their investments and see their money grow at a bargain price.